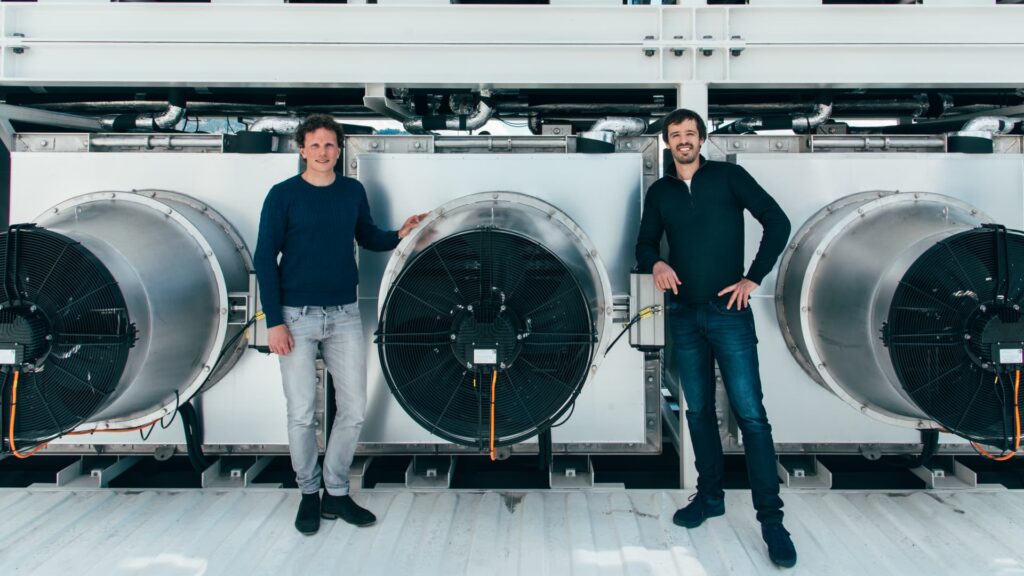

Christoph Gebald (left) and Jan Wurzbacher, co-founders of Climeworks.

Photo courtesy Climeworks

Carbon dioxide removal startup Climeworks announced on Tuesday it is building a second commercial-sized plant in Iceland. When fully operational in 18 to 24 months, the plant will capture and store 36,000 metric tons per year of carbon dioxide, the company says.

That amounts to a minuscule percentage of the total global emissions of carbon dioxide released into the air each year: In 2021, they hit a record high of 36.3 billion metric tonsaccording to the International Energy Agency, a Paris-based intergovernmental energy organization.

But this new factory, alongside a smaller one in Iceland that has the capacity to remove 4,000 tons a year, are just the first steps Climeworks is taking toward its goal of removing multiple millions of tons of carbon dioxide a year by 2030, and 1 billion tons per year by 2050.

Those targets are many orders of magnitude higher than where Climeworks is right now, but as co-founder and co-CEO Jan Wurzbacher CNBC in May, the team has been at it for 13 years and has seen the technology told improve vastly during that time.

“We started with milligrams of carbon dioxide captured from the air. Then we went from milligrams to grams, from grams to kilograms to tons to 1,000 tons. So we did quite a couple of these steps already.”

Artist rendering of the new carbon capture and sequestration plant announced by Climeworks in June. This new plant, called Mammoth, will take between 18 to 24 months to build and will have a capacity to capture 36,000 metric tons of carbon dioxide per year.

Artist rendering courtesy Climeworks

Facing a sea of skepticism

Wurzbacher and Christoph Gebald launched Climeworks in 2009 as a spinoff of ETH Zürich, the main technical university in Switzerland’s largest city.

The idea of vacuuming carbon dioxide out of the air has been getting more mainstream attention and hundreds of millions of funding recently. In April, payment processor Stripe, Google parent AlphabetFacebook parent Meta, Shopify and McKinsey announced they were teaming up to commit to purchase almost $1 billion worth of carbon dioxide removal from companies that are developing the technology. A couple days later, Chris Sacca’s climate investment company, Lowercarbon Capital, announced a $350 million fund to invest in carbon removal startups.

That kind of momentum in the industry was certainly not the norm when Climeworks started.

“Back in 2009, the environment was definitely very different,” Wurzbacher told CNBC. “There was an ongoing climate debate, but it was more a debate about how we can avoid emissions. And when we came up with the method of capturing carbon dioxide from the atmosphere, many people said, ‘Hey, wait a minute, let’s not waste our time with that.”‘”

An early version of the Climeworks carbon removal technology from 2012.

Photo courtesy Climeworks

But now, in addition to the private sector investment, the United Nations’ leading climate science organization, the Intergovernmental Panel on Climate Change (IPCC)included carbon capture in its April update for addressing global warming.

“Carbon Dioxide Removal (CDR) is necessary to achieve net zero carbon dioxide and greenhouse gas emissions both globally and nationally, counterbalancing ‘hard-to-abate’ residual emissions,” The technical summary of the IPCC recommendations says. “CDR is also an essential element of scenarios that limit warming to 1.5°C or likely below 2°C by 2100, regardless of whether global emissions reach near zero, net zero or net negative levels.”

There are other ways to remove carbon dioxide from the atmosphere besides vacuuming it from the air.

Planting trees is a natural method, but that takes a lot more land than the factories Climeworks is building to remove an equivalent amount of CO2. Also, a tree can die, be cut down or burned after it is planted, making it hard to account for how much CO2 it will actually remove over its lifetime. Carbon dioxide removed from the air mechanically, as Climeworks does, can be permanently stored underground.

When Wurzbacher and Gebald were sure that technical carbon dioxide removal would be necessary to respond to climate change, many others were not.

“Of course, there were a lot of skeptics at that point in time,” Wurzbacher told CNBC. “We didn’t know what would happen or exactly how things would turn out, how long it would take to develop the technology, to scale the technology — but for us, it was somehow clear that this is something that will be needed.”

Wurzbacher, 38, was just 25 years old when the company started. “We just went on and didn’t listen too much” to the doubters, he said.

An early version of the Climeworks carbon removal technology from 2016.

Photo courtesy Climeworks

From zero to ‘overwhelming’ demand

After developing the carbon removal technology in the lab for close to a decade, Climeworks built its first plant in Hinwil, Switzerlandin 2017.

At that time, Climeworks sold the carbon dioxide it captured to customers like a local greenhouse for using in fertilizing vegetable growth and to beverage maker Coca-Cola. These kinds of initial niche applications were “not climate-relevant,” Wurzbacher told CNBC, but were simply a demonstration of the technology itself.

“From the very beginning, the goal was always to come up with a climate relevant solution,” Wurzbacher said. Early on, we “looked for niche applications to get things rolling because there was no market at that point in time for negative emissions.”

The Climeworks carbon capture plant in Iceland.

Photo courtesy Climeworks.

But years later, as consumers and businesses grew more concerned about climate change, the company began seeing demand. In 2018, Climeworks began allowing individuals to pay anything from $36 to $120 per month to have the company remove some amount of carbon dioxide from the atmosphere on their behalf. So far, more than 14,000 people have signed on.

Around the same time, corporate clients including MicrosoftStripe, and Shopify, are doing business with Climeworks in order to demonstrate their climate commitments.

Now, Climeworks is primarily removing carbon and storing it underground by mineralizing it with basalt rock. Selling captured carbon dioxide for use in fizzy drinks or in greenhouses, are “more or less negligible,” Wurzbacher told CNBC.

Carbon removal demand is largely coming from companies who see climate goals — being able to sell a product as either carbon neutral or carbon negative — as a “vital ingredient to their business in the future,” Wurzbacher told CNBC. “Those companies that are currently our customers, they are taking the fact that they are removing carbon from the atmosphere and making that an element of their products and of their services.”

Climeworks existing carbon removal and sequestration factory in Iceland.

Photo courtesy Climeworks

In September 2021, Climeworks opened its first commercial direct air carbon capture and storage plant in Iceland. It is composed of eight carbon capturing modules made from 44 shipping containers with filters inside that are able to remove 4,000 tons of carbon dioxide per year.

Climeworks picked Iceland to open its first plant in part because its carbon storage partner, CarbFix, is based there, and because there are sufficient sources of renewable energy in Iceland. It would be counterproductive to burn fossil fuels, which release carbon dioxide into the atmosphere, to power a carbon removal plant.

Until recently, Climeworks was funded by about $150 million of money from private individual investors. But in April, Climeworks announced it raised $650 million from a collection of investors including, among others, Global Founders Capital, John Doerr, and Swiss Re.

“The market for carbon dioxide removal has basically had an exponential development over the past two, two and a half years,” Wurzbacher told CNBC. “It’s overwhelming basically, what is happening right now.”

In addition to ramping up its capacity, Climeworks is also focused on reducing the cost. In the middle of this decade, cost will probably be $500 per ton of carbon dioxide removed. By 2030, the cost will be around $300 per ton and in the middle of the next decade, the cost is projected to be about $200 per ton.

Currently, Climeworks’ business relies on climate-conscious companies and individuals, but government incentives are seen as a way that the company and ones like it could build enough large factories to make a dent in climate change mediation. Governments could also help drive demand in the space through regulated and mandated carbon budgets or a price on carbon.

“Eventually, policy will be required to scale this up,” Wurzbacher said.

For now, Climeworks is focused on reducing the cost of carbon removal and scaling up the Climeworks operation with money from investors. But longer term, “in order to then roll that out and get from tens of millions of tons to billions of tons, we do need policy and we do need regulation to reach that order of magnitude and that scale,” he added.

.