Chris Hondros/Getty Images News

I would preface this article by stating I do not consider myself a banking expert. I do not follow individual company decisions and balance sheets closely. Why? Most financial stocks tend to move slowly, and have histories of flatlining for 5-10 years at a time. However, I have watched this sector fluctuate in price and value over 35 years. So, of course I do have some opinions. The June 23rd major bank Stress Test results came out yesterday, and it looks like the big banks and brokerages are somewhat prepared for a deep recession. That’s definitely good news, as the 2008-09 Great Recession crisis was born in excessive leverage and debt. Currently, the whole sector has been forced by the Federal Reserve to carry less leverage (about half of the early 2008 rate in practice). Gone are the days of 20:1 and 25:1 leverage (liabilities and debts) vs. accounting capital (book value). Now 10 to 1 leverage is considered excessive.

If you forced me to pick my favorite financial equity to own right now, I would say Goldman Sachs (NYSE:GS). I have written on Goldman several times since the 2020 pandemic hit. I recommended here Investors buy the stock around $200 in the summer of 2020. That proved a decent call, as the quote rose to $420 a year and a half later. Then in February here of this year, I suggested a weakening US marketplace for stocks and bonds would hurt its ability, and equity value. Since that effort, GS has declined around -20%.

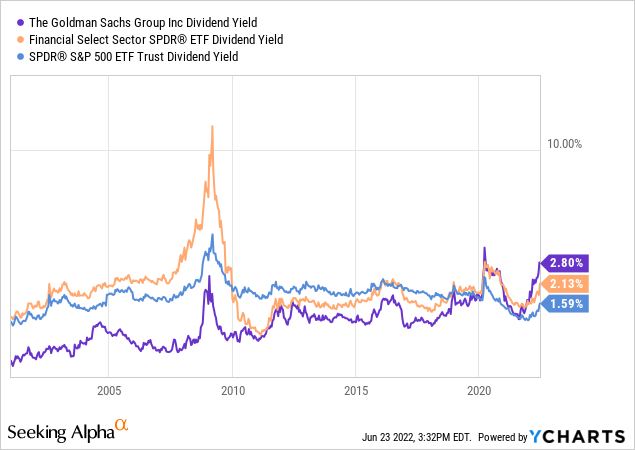

The reasons I am upgrading my GS rating to Buy are numerous and expanding. Goldman’s Federal Reserve stress test results were awesomely positive. Earnings are projected by analysts to hold up better than I expected earlier in the year. The company is again trading below the book value of its shares, which has been a smart area to buy the last decade. And, the current dividend yield around 3% is the strongest “relative” number ever vs. the financial sector and the S&P 500 (GS went public in an IPO in 1999). If you like to invest in strength, value, quality, and safety, while getting a nice dividend to boot, Goldman Sachs is an interesting and unique choice around $286 a share.

2022 Stress Test Results

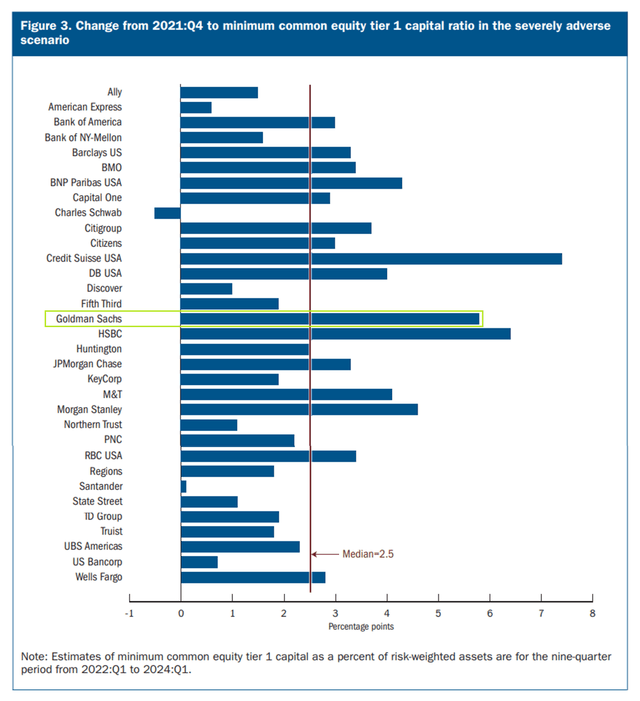

Effectively, Goldman Sachs runs one of the strongest and most conservative balance sheets in the financial sector. The Big Bank stress test results of June 23rd confirmed operations should remain rock solid, even in a horrific recession scenario. The Federal Reserve’s hypothetical recession test this year made far more pessimistic assumptions than last year, and GS passed with flying colors. Below is additional information on the stress test setup taken directly from the Fed report, and tables on how well Goldman survived,

This year’s hypothetical scenario is tougher than the 2021 test, by design, and includes a severe global recession with substantial stress in commercial real estate and corporate debt markets. The unemployment rate rises by 5-3/4 percentage points to a peak of 10 percent and GDP declines commensurately. Asset prices decline sharply, with a nearly 40 percent decline in commercial real estate prices and a 55 percent decline in stock prices.

Total losses were largely driven by more than $450 billion in loan losses and $100 billion in trading and counterparty losses. This year, larger banks saw an increase of over $50 billion in losses compared to the 2021 test. Additionally, the overall 2.7 percent decline in capital is slightly larger than the 2.4 percent decline from last year’s test but is comparable to recent years.

2022 Federal Reserve Stress Test Results

2022 Federal Reserve Stress Test Results

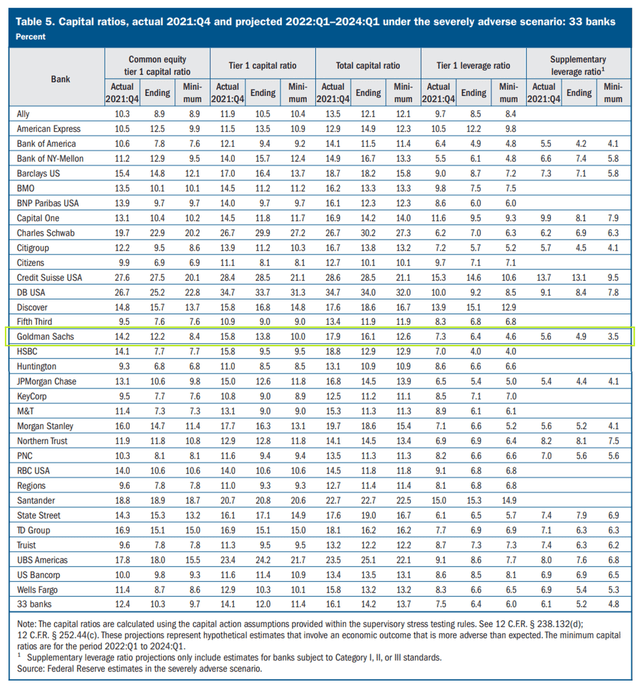

Earnings Holding Up

The main reason for my skittishness about Goldman Sachs in February revolved around peak earnings, as stocks and bonds on Wall Street were beginning to slide faster into bear markets. EPS peaked at $59 last year with a current 2022 forecast by analysts of $37. The bullish news is a stability of the markets alongside a mildly growing economy are projected to increase earnings per share to $40 in 2023.

Seeking Alpha Table – Consensus Estimates June 24th, 2022

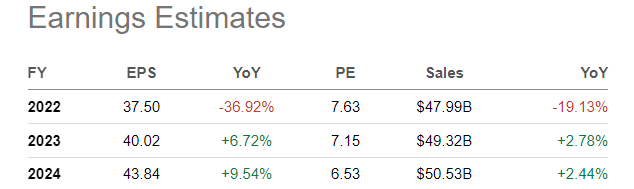

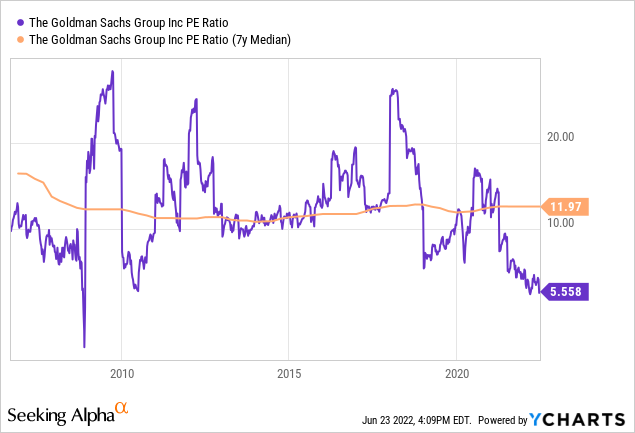

Using “peak” trailing results of earnings and sales, Goldman looks incredibly cheap today. Below is a 22-year graph of how low the basic June valuation has become since the company moved from a private ownership structure to public trading.

YCharts

With a 7-year median average of roughly 12x EPS, a $37 income number works out to $444 for a “fair value,” all other variables remaining equal. On $40 EPS in 2023, a fair value target closer to $480 is not out of the question. Both are equal numbers better than I was projecting in February.

YCharts

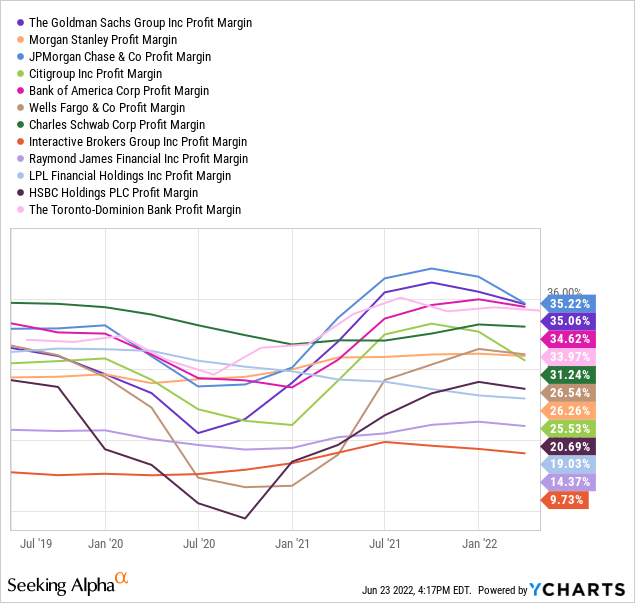

In addition to a bargain valuation on trailing results, a low forward 1-year P/E calculation is available from this Fed stress test winner. Against major peers and competitors in the brokerage and banking space, Goldman Sachs stands out as a buy proposition. Below I am comparing the company to Morgan Stanley (MS), JPMorgan Chase (JPM), Citigroup (C), Bank of America (BAC), Wells Fargo (WFC), Charles Schwab (SCHW), Interactive Brokers (IBKR), Raymond James (RJF), LPL Financial (LPLA), HSBC Holdings (HSBC), and Toronto-Dominion Bank (TD).

YCharts

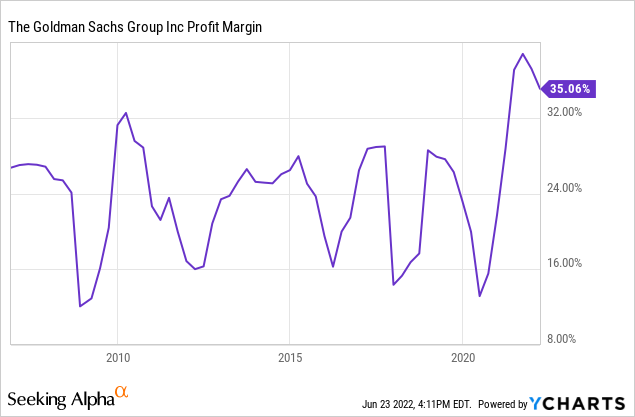

Another positive for shareholders, Goldman Sachs runs a tight ship with one of the highest profit margins in the industry vs. sales. Below are graphs of this desirable statistic. As an owner, higher margins allow for greater levels of safety when business trends turn south, and usually are correlated with the best valuation setups when assets are bought/sold.

YCharts

YCharts

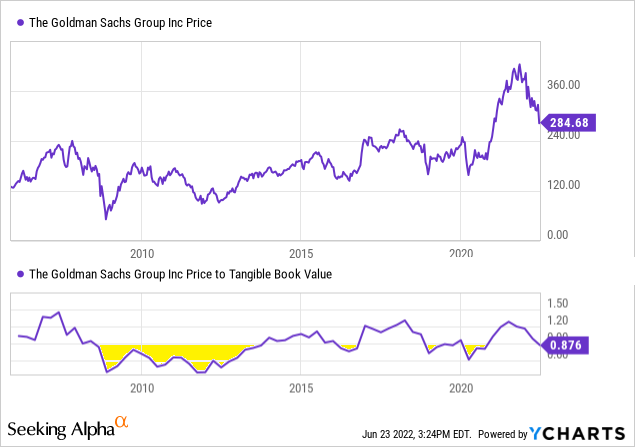

Book Value Support

But that’s not all the good news for Goldman stakeholders. Equity ownership interests are now available for investment at less than stated tangible book value. The stock has a terrific history of being worth the same or more than its accounting book value, especially since mark-to-market accounting became the norm decades ago. Outside of the 2008-09 Great Recession and slow banking reflation effort for several years thereafter, Goldman has rarely traded below its accounting book value. Each time that it has, investors would have been wise to scoop up shares. My read of the current discount is any further drop in the GS equity price from $286 should be purchased, as part of your financial sector allocation in portfolio construction.

YCharts

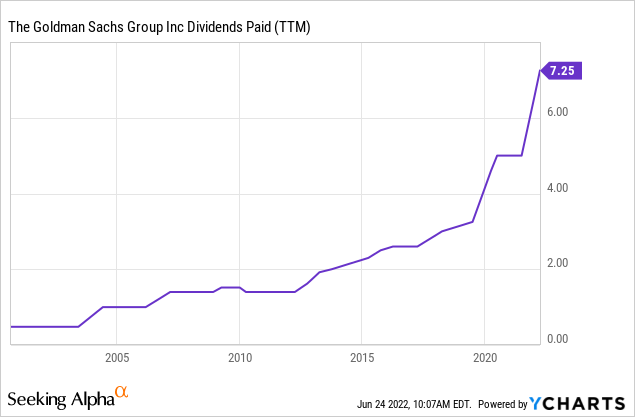

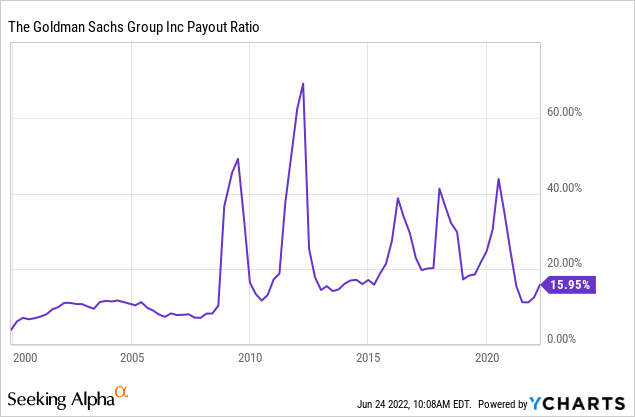

Extraordinary Dividend Yield

Perhaps the best buy argument for Goldman today is its high and steadily rising dividend yield. At 2.9% on a forward basis, the regular quarterly payout is far better than either the financial industry average or the S&P 500 index overall. On top of this wonderful opportunity for upfront yield, the company has a history of raising payouts, almost every year. Plus, the payout ratio of 15%-20% of earnings current is amazingly low vs. an S&P 500 reading above 40%. I have drawngraphs to illustrate the cash distribution ideas below, including a long-term yield comparison vs. the Financial Select Sector SPDR ETF (XLF) and leading large-cap SPDR S&P 500 ETF (SPY).

YCharts

YCharts

YCharts

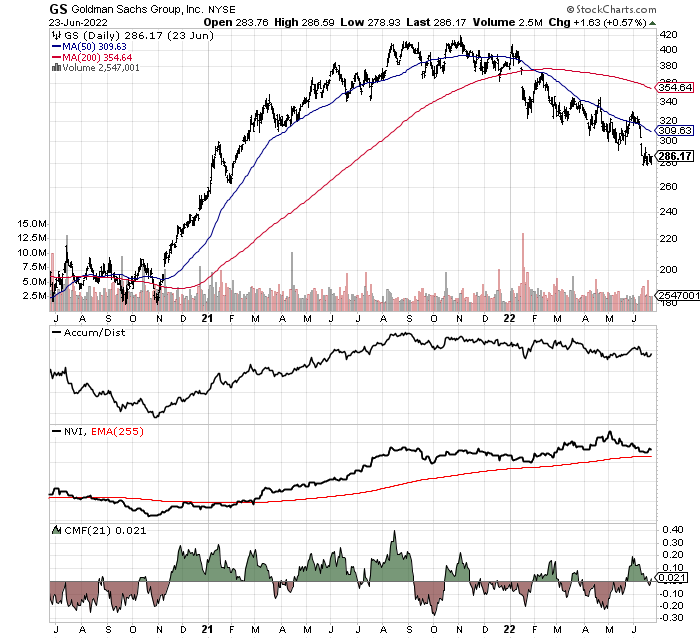

Technical Trading Chart

Given the 25% to 30% dump in US equity indexes and dismal year for bonds, I would have expected exaggerated negative effects to hit the GS operating business and stock quote. Investor selling has been relatively limited, with an industry-typical -30% price decline outlined since November.

A variety of momentum indicators, like those pictured below, have not screamed of excessive specific selling in Goldman Sachs during the first half of 2022. Of course, a severe recession could cause more damage in the second half, but a mild recession may already be factored into a sub-$300 price.

StockCharts.com

Final Thoughts

Goldman Sachs is not a traditional bank that focuses on lending through long-term loans, funded and financed through short-term deposits. The worst time to own banks is when the Treasury yield curve is inverted, as it quickly becomes unprofitable to make new loans on the spread, just as defaults begin to chip away at underlying book value when recession hits. Since that’s the spot in the economic cycle we are sitting today, I still would prefer not to own the Big Banks until short-term interest rates are declining again. Since the Federal Reserve is intent on raising deposit rates quickly to stop inflation, I have been absent from posting bullish articles on the sector for some time. I have written bearish notes on the industry’s Financial Select Sector SPDR ETF over the past 12 months, and penned several hold articles on Citigroup, which I would rate as my second favorite large-capitalization bank investment today.

The ultra-positive stress test result means management can buy back shares under book value and raise the dividend, if they choose. I would recommend GS increase returns of capital to shareholders as a way to create long-term value, which could be announced Monday or Tuesday of next week, following past stress test outcomes. Share repurchases under $300 would also be mathematically accretive to per share BV and EPS.

What could drive the stock quote yet lower? That’s a good question. For sure, a stock market or bond market collapse would affect GS the most. It’s more of a trading house and brokerage with commissions and fees tied to the health of the financial markets. On the flip side of this risk, if equities and bonds are reaching for a bottom in June, Goldman Sachs could see a rising stock quote the remainder of the year.

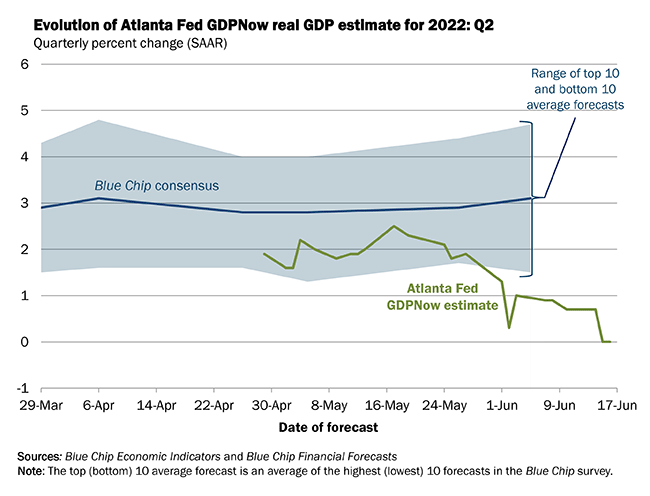

A second risk to contemplate is a deep recession scenario. While the company’s operations will survive such an outcome, they will not thrive. With mark-to-market accounting, huge issues in the economy with defaults and lower asset values will reduce book value and the equity quote. I am quite sure we are entering a recession, with economic output continuing to worsen until the Federal Reserve relents on its interest-rate hike campaign. Record low consumer confidence surveys, plus negative real GDP reports in Q1 and possibly in Q2 according to the Atlanta Fed GDPNow estimate are worrisome.

Atlanta FED – GDPNow Report

Outside of a stock market crash or deep recession, I am modeling potential downside is limited to $250 a share. Upside potential is a return trip to $400 during 2023, which may still represent a low 10x P/E if current estimates prove out. $450 in 12 months is a real possibility given a mild recession finishes in 2022, and interest rates do not climb much further (beyond the next Fed rate hike this summer). In all likelihood, a falling stock quote from $286 would open an even smarter buy opportunity long term.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.