If you have aspirations to grow your business but don’t have the funds to kickstart your vision, we have great news: Fast Capital 360 is here to help make your dreams come true.

While there are plenty of ways to finance growth or sustain operations, small businesses qualify for financing through large banks can be challenging. Fast Capital 360 aims to fill that critical gap within the financial marketplace. In short, the company’s goal is to enrich lives and promote business growth by connecting business owners to fast loan opportunities while delivering expert guidance throughout the journey.

How Fast Capital 360 stands out

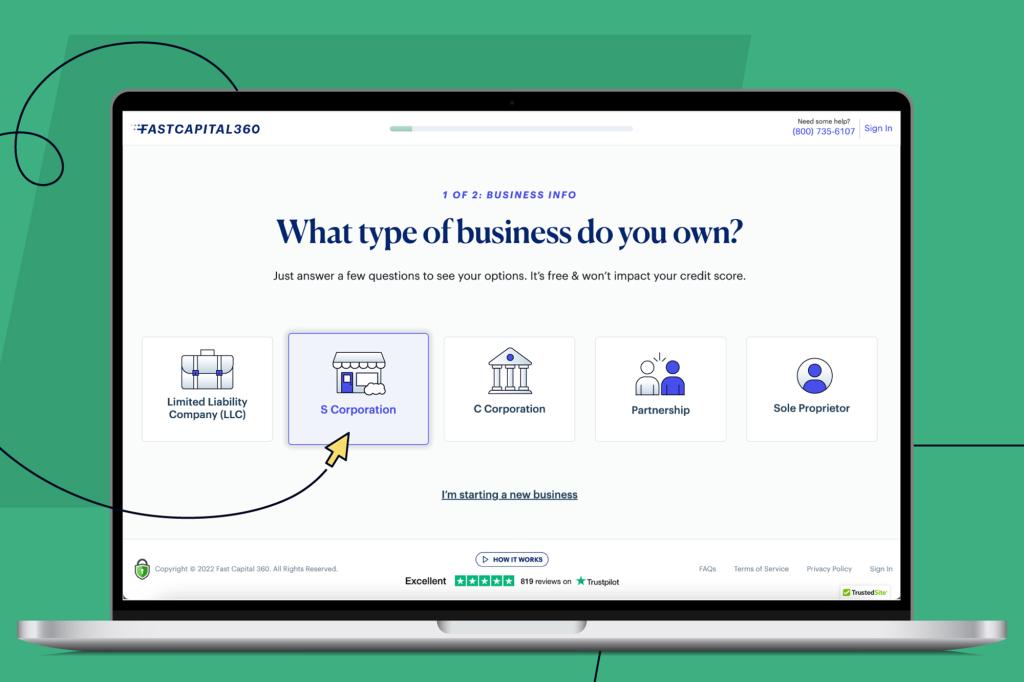

Choose from leading small business lenders. All you have to do to gain access to a nationwide network of reputable lenders is fill out one simple online application. As a responsible business owner, you don’t want to settle on the first financing option you come across. Fast Capital 360 allows you to find the best choice for your business easily.

Find financing, even if you’ve been rejected before. Finding a lender that will work with your small business can be challenging. But with Fast Capital 360, you’re paired with lenders whose eligibility requirements you can meet. This means you can free yourself from the time (and the hassle) of applying to lenders who aren’t the right fit for your organization.

Discover a new world of financing options. Many financing options are available to small business owners, from merchant cash advances to business lines of credit to SBA loans. But if you don’t know what’s out there and how it can benefit your business, how do you know where to start? With Fast Capital 360’s network of alternative lenders, the company can connect you with financing programs you didn’t know your business could qualify for. With a clear understanding of what’s possible, you can pick the option that best positions your company for success.

Get expert advice

As a small business owner, you know a lot about what it takes to run a successful small business. However, obtaining the capital you need to run your business and achieve growth is almost always complicated. If you’re not a finance professional, navigating different lending products can be confusing, time-consuming and intimidating.

To make life simpler, Fast Capital 360 assigns a dedicated business advisor to every account to make the process of acquiring capital as painless as possible — you’ll know exactly what’s needed and when. When you’re ready to compare offers, your business advisor will help you decipher the financial jargon and terms so that you can make informed decisions.

Note: Fast Capital 360 isn’t rewarded for working with one lender over another, which means the brand will never push an option that isn’t right for your business and need.

Immediately secure the funds you need to prosper and grow

When it comes down to running a small business, cash is king — you need it to buy inventory, meet payroll, market your goods/services and grow. When reserves run low, or growth expenses outpace incoming receivables, you need an influx of cash, and you need it fast. Unfortunately, small business funding isn’t known for its speed, but with Fast Capital 360, you can immediately secure the money you need to expand.

Whether you need capital to sustain operations or pursue an opportunity, fast funding often is the difference between a dream and a dream come true. With Fast Capital 360, you won’t spend hours filling out paperwork. The company fast-tracks the process using a simple, secure, meticulously refined online application to produce the best possible end-user experience.

Receive loans for as large as $500,000 and rates as low as 6.75 percent. Apply within less than 5 minutes and get a loan for your small business in as little as 24 hours.

For more information, check out the Fast Capital 360 website and reach out to a customer service agent today.

Check out the New York Post Shopping section for more content.

.